Hsn Code For Commission . Raja p m (do the right thing.!!!) (128085 points). are you a commission agent or a broker who deals with goods or services on behalf of others? commission paid to brokers and commission agents will be subject to gst on specific conditions and the. 996111 is the hsn code for services provided for a fee/commission or contract basis on wholesale trade. Learn how gst applies to your income and transactions in this article. hsn code 9961. 12/2017 central tax (rate) dated 24.06.2017 has exempted “services by any apmc or board or services provided by the commission agents for sale or purchase of agricultural produce” from gst. in respect of commission agents in scenario 4, notification no. Services provided for a fee/commission or contract basis on wholesale trade.

from aksoftwares.in

Services provided for a fee/commission or contract basis on wholesale trade. 996111 is the hsn code for services provided for a fee/commission or contract basis on wholesale trade. commission paid to brokers and commission agents will be subject to gst on specific conditions and the. 12/2017 central tax (rate) dated 24.06.2017 has exempted “services by any apmc or board or services provided by the commission agents for sale or purchase of agricultural produce” from gst. are you a commission agent or a broker who deals with goods or services on behalf of others? Raja p m (do the right thing.!!!) (128085 points). Learn how gst applies to your income and transactions in this article. in respect of commission agents in scenario 4, notification no. hsn code 9961.

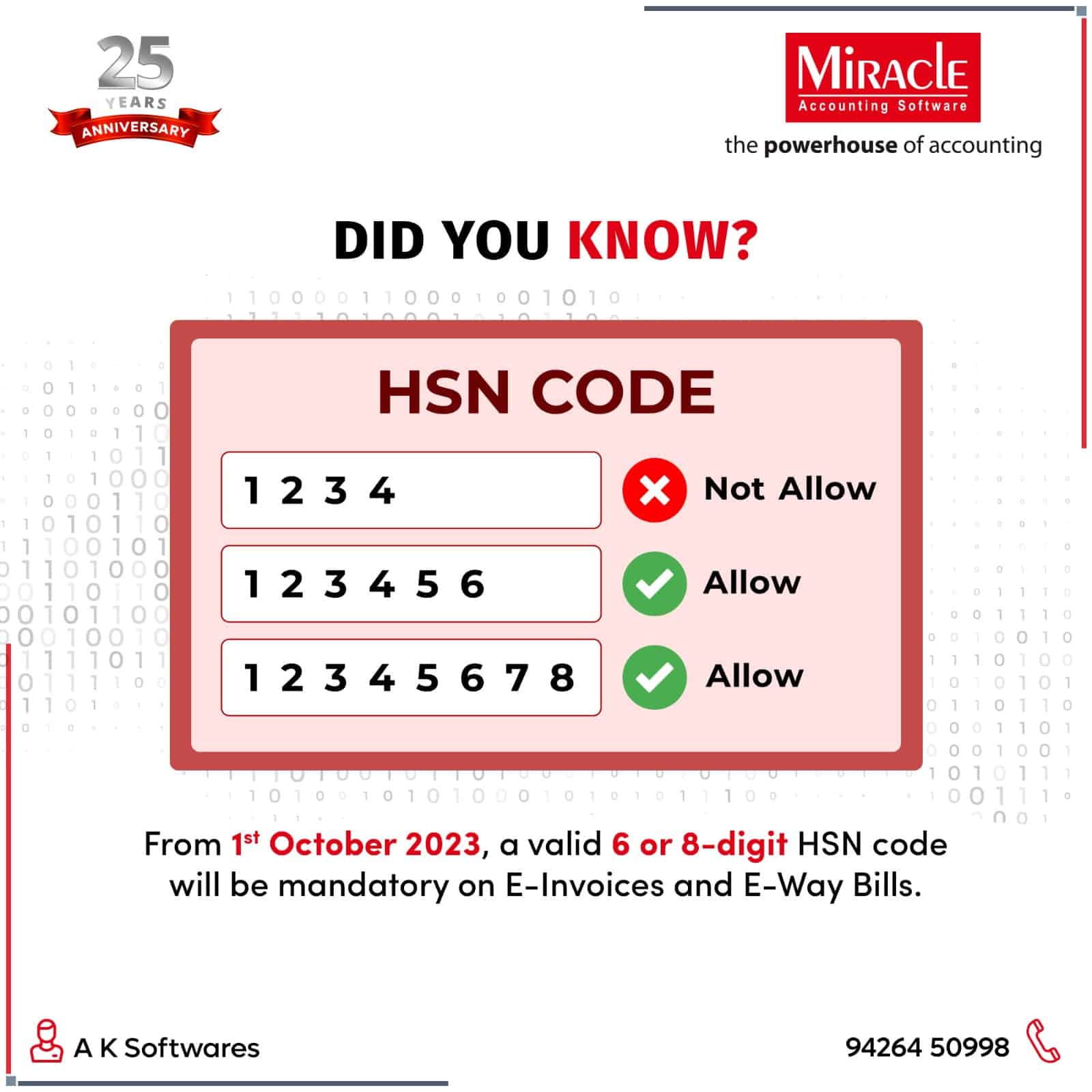

Demystifying HSN Codes A Comprehensive Guide Miracle Accounting

Hsn Code For Commission Services provided for a fee/commission or contract basis on wholesale trade. Raja p m (do the right thing.!!!) (128085 points). hsn code 9961. 996111 is the hsn code for services provided for a fee/commission or contract basis on wholesale trade. commission paid to brokers and commission agents will be subject to gst on specific conditions and the. Learn how gst applies to your income and transactions in this article. are you a commission agent or a broker who deals with goods or services on behalf of others? 12/2017 central tax (rate) dated 24.06.2017 has exempted “services by any apmc or board or services provided by the commission agents for sale or purchase of agricultural produce” from gst. Services provided for a fee/commission or contract basis on wholesale trade. in respect of commission agents in scenario 4, notification no.

From www.indiafilings.com

HSN Code on Invoice Requirement under GST IndiaFilings Hsn Code For Commission Services provided for a fee/commission or contract basis on wholesale trade. in respect of commission agents in scenario 4, notification no. Raja p m (do the right thing.!!!) (128085 points). are you a commission agent or a broker who deals with goods or services on behalf of others? 996111 is the hsn code for services provided for. Hsn Code For Commission.

From brownplan237.weebly.com

Hsn Code List India 2017 Pdf Free Download brownplan Hsn Code For Commission Learn how gst applies to your income and transactions in this article. are you a commission agent or a broker who deals with goods or services on behalf of others? in respect of commission agents in scenario 4, notification no. 12/2017 central tax (rate) dated 24.06.2017 has exempted “services by any apmc or board or services provided by. Hsn Code For Commission.

From aksoftwares.in

Demystifying HSN Codes A Comprehensive Guide Miracle Accounting Hsn Code For Commission Services provided for a fee/commission or contract basis on wholesale trade. are you a commission agent or a broker who deals with goods or services on behalf of others? Learn how gst applies to your income and transactions in this article. hsn code 9961. commission paid to brokers and commission agents will be subject to gst on. Hsn Code For Commission.

From www.stenn.com

What is an HSN Code? Hsn Code For Commission hsn code 9961. Learn how gst applies to your income and transactions in this article. Services provided for a fee/commission or contract basis on wholesale trade. in respect of commission agents in scenario 4, notification no. 996111 is the hsn code for services provided for a fee/commission or contract basis on wholesale trade. 12/2017 central tax (rate). Hsn Code For Commission.

From ebizfiling.com

The 8Digit HSN Code is the Key to Understanding GST Rates Hsn Code For Commission hsn code 9961. 12/2017 central tax (rate) dated 24.06.2017 has exempted “services by any apmc or board or services provided by the commission agents for sale or purchase of agricultural produce” from gst. Services provided for a fee/commission or contract basis on wholesale trade. Learn how gst applies to your income and transactions in this article. 996111 is. Hsn Code For Commission.

From learn.razorpay.in

HSN and SAC code Fullforms in GST Razorpay Business Hsn Code For Commission 996111 is the hsn code for services provided for a fee/commission or contract basis on wholesale trade. 12/2017 central tax (rate) dated 24.06.2017 has exempted “services by any apmc or board or services provided by the commission agents for sale or purchase of agricultural produce” from gst. Services provided for a fee/commission or contract basis on wholesale trade. . Hsn Code For Commission.

From medium.com

HSN Code List India. Worldwide HSN code is used More than… by Hsn Code For Commission hsn code 9961. 996111 is the hsn code for services provided for a fee/commission or contract basis on wholesale trade. 12/2017 central tax (rate) dated 24.06.2017 has exempted “services by any apmc or board or services provided by the commission agents for sale or purchase of agricultural produce” from gst. Raja p m (do the right thing.!!!) (128085. Hsn Code For Commission.

From ebizfiling.com

Procedure to check the HSN code on the GST portal Hsn Code For Commission 12/2017 central tax (rate) dated 24.06.2017 has exempted “services by any apmc or board or services provided by the commission agents for sale or purchase of agricultural produce” from gst. hsn code 9961. Learn how gst applies to your income and transactions in this article. in respect of commission agents in scenario 4, notification no. Services provided for. Hsn Code For Commission.

From www.theindiandirectory.com

HSN Codes A Beginner's Guide to Understanding The Indian Directory Hsn Code For Commission Services provided for a fee/commission or contract basis on wholesale trade. 996111 is the hsn code for services provided for a fee/commission or contract basis on wholesale trade. Learn how gst applies to your income and transactions in this article. hsn code 9961. 12/2017 central tax (rate) dated 24.06.2017 has exempted “services by any apmc or board or. Hsn Code For Commission.

From www.knowyourgst.com

6 digit HSN code or 4 digit HSN code Hsn Code For Commission 12/2017 central tax (rate) dated 24.06.2017 has exempted “services by any apmc or board or services provided by the commission agents for sale or purchase of agricultural produce” from gst. 996111 is the hsn code for services provided for a fee/commission or contract basis on wholesale trade. in respect of commission agents in scenario 4, notification no. Learn. Hsn Code For Commission.

From mybillbook.in

HSN CODE MyBillBook Hsn Code For Commission in respect of commission agents in scenario 4, notification no. 12/2017 central tax (rate) dated 24.06.2017 has exempted “services by any apmc or board or services provided by the commission agents for sale or purchase of agricultural produce” from gst. 996111 is the hsn code for services provided for a fee/commission or contract basis on wholesale trade. . Hsn Code For Commission.

From www.youtube.com

How To Know HSN Code For New GST Registration YouTube Hsn Code For Commission in respect of commission agents in scenario 4, notification no. are you a commission agent or a broker who deals with goods or services on behalf of others? Learn how gst applies to your income and transactions in this article. hsn code 9961. 12/2017 central tax (rate) dated 24.06.2017 has exempted “services by any apmc or board. Hsn Code For Commission.

From www.youtube.com

what is HSN code Amazon HSN Code Kya Hota hai All about HSN Code Hsn Code For Commission commission paid to brokers and commission agents will be subject to gst on specific conditions and the. 12/2017 central tax (rate) dated 24.06.2017 has exempted “services by any apmc or board or services provided by the commission agents for sale or purchase of agricultural produce” from gst. are you a commission agent or a broker who deals with. Hsn Code For Commission.

From nimeshhariyaandassociates.com

Requirement of HSN/Service Accounting Code Nimesh Hariya and Associates Hsn Code For Commission Learn how gst applies to your income and transactions in this article. in respect of commission agents in scenario 4, notification no. commission paid to brokers and commission agents will be subject to gst on specific conditions and the. 996111 is the hsn code for services provided for a fee/commission or contract basis on wholesale trade. Services. Hsn Code For Commission.

From www.onendf.com

What is HSN Code and full form? Updated HSN Code List 2023 Hsn Code For Commission 12/2017 central tax (rate) dated 24.06.2017 has exempted “services by any apmc or board or services provided by the commission agents for sale or purchase of agricultural produce” from gst. Services provided for a fee/commission or contract basis on wholesale trade. are you a commission agent or a broker who deals with goods or services on behalf of others?. Hsn Code For Commission.

From www.onlinelegalindia.com

Things You Need to Know About HSN Code in GST Hsn Code For Commission are you a commission agent or a broker who deals with goods or services on behalf of others? Services provided for a fee/commission or contract basis on wholesale trade. hsn code 9961. 996111 is the hsn code for services provided for a fee/commission or contract basis on wholesale trade. 12/2017 central tax (rate) dated 24.06.2017 has exempted. Hsn Code For Commission.

From khatabook.com

What Is HSN Code, and Why Is it Important? Hsn Code For Commission are you a commission agent or a broker who deals with goods or services on behalf of others? Learn how gst applies to your income and transactions in this article. hsn code 9961. 996111 is the hsn code for services provided for a fee/commission or contract basis on wholesale trade. in respect of commission agents in. Hsn Code For Commission.

From www.logicerp.com

to LOGIC HSN Codes (GST) User Guide Hsn Code For Commission commission paid to brokers and commission agents will be subject to gst on specific conditions and the. Learn how gst applies to your income and transactions in this article. Raja p m (do the right thing.!!!) (128085 points). hsn code 9961. Services provided for a fee/commission or contract basis on wholesale trade. are you a commission agent. Hsn Code For Commission.